The Situation and the Changing Business Climate

BFSI enterprises have been entirely altered by digital, and IT is no longer restricted to delivering online and mobile capability; it has revolutionized the range of services they provide to clients, and it has changed the way businesses manage and operate in a highly regulated environment.

Organizations can now design, enable, and deliver value from their digital business journeys more efficiently. The future of the customer-bank relationship is defined by technology. IT has a bigger role to play in the future of corporate plans and operations since it creates new opportunities and capabilities.

BFSI Digital Transformation

Digital transformation integrates digital into the company and service value chain. A proper digital strategy is a vital need for the future success of banks and financial institutions. The increasing adoption of smart devices with incredible computing power for customers, as well as the evolution of technologies such as Robotics, Artificial Intelligence, IoT, Cloud Computing, Blockchain & Cryptos, Biometrics, Big Data, and Analytics, Virtual Reality/Augmented Reality, and Mixed Reality for businesses, has created new opportunities for businesses to transform relationships into new revenue streams for competitive advantage, cost reduction, and superior customer experience.

Future banking and Organization Imperatives

Experience with Customers

-

Individualized experiences, relevance, and quickness in delivering the desired product and service are all part of hyper-personalization.

-

Human touch interactions enhancement of the digital experience, making it more customized and contextualized.

-

Transparency. Security and confidence in how their money and data are handled.

Excellence in Business

-

Through technology, intelligent and autonomous processes are reinforced with exception handling.

-

With a CSI culture established in the system, transformation levers are used across all elements of processes.

-

Transformation Analytics allow for real-time optimization of operational and engagement models to improve return on investment.

Management of Risk

-

Through technology, intelligent and autonomous processes are reinforced with exception handling.

-

Follow the growing regulatory requirements and show compliance and control.

-

With low or no impact on consumers, banks, and the community, innovation and proactive measures are enhancing resilience detection and recovery of services.

Digital transformation is a composite of a business model (strategy, business process, technology, innovation, and culture) rather than a monochrome. As a result, it’s critical that the digital transformation strategy be thorough and complete.

Our Approach

Any digital transformation program should aim to provide a superior business and end-user experience by providing a flexible, responsive, and forward-thinking service that meets current and future business demands at a low cost.

Customers

- Individualized Customer Service

- A consistent omnichannel experience

- Ensure the greatest degree of data and money security.

Business Excellence

- Successfully supporting the business by demonstrating leadership, teamwork, and responsibility.

- Targeted adoption of the Future of Work

- Differentiated Service Classes – “Fit for Purpose”

- Self-help/self-healing initiative improved performance

- Continuous service enhancements and team tactics deployment

Digital

- Rather of large-scale “carpet bombing” deployments, choose technology that is suited for the purpose.

- The transition from thick to thin clients, keeping interfaces light and User Experience at the forefront.

- Benchmarking and comparing to industry norms and trends in adaptation

- Align current assets to ensure that they are “fit for purpose” and provide value.

- Technology mobilization that is proactive

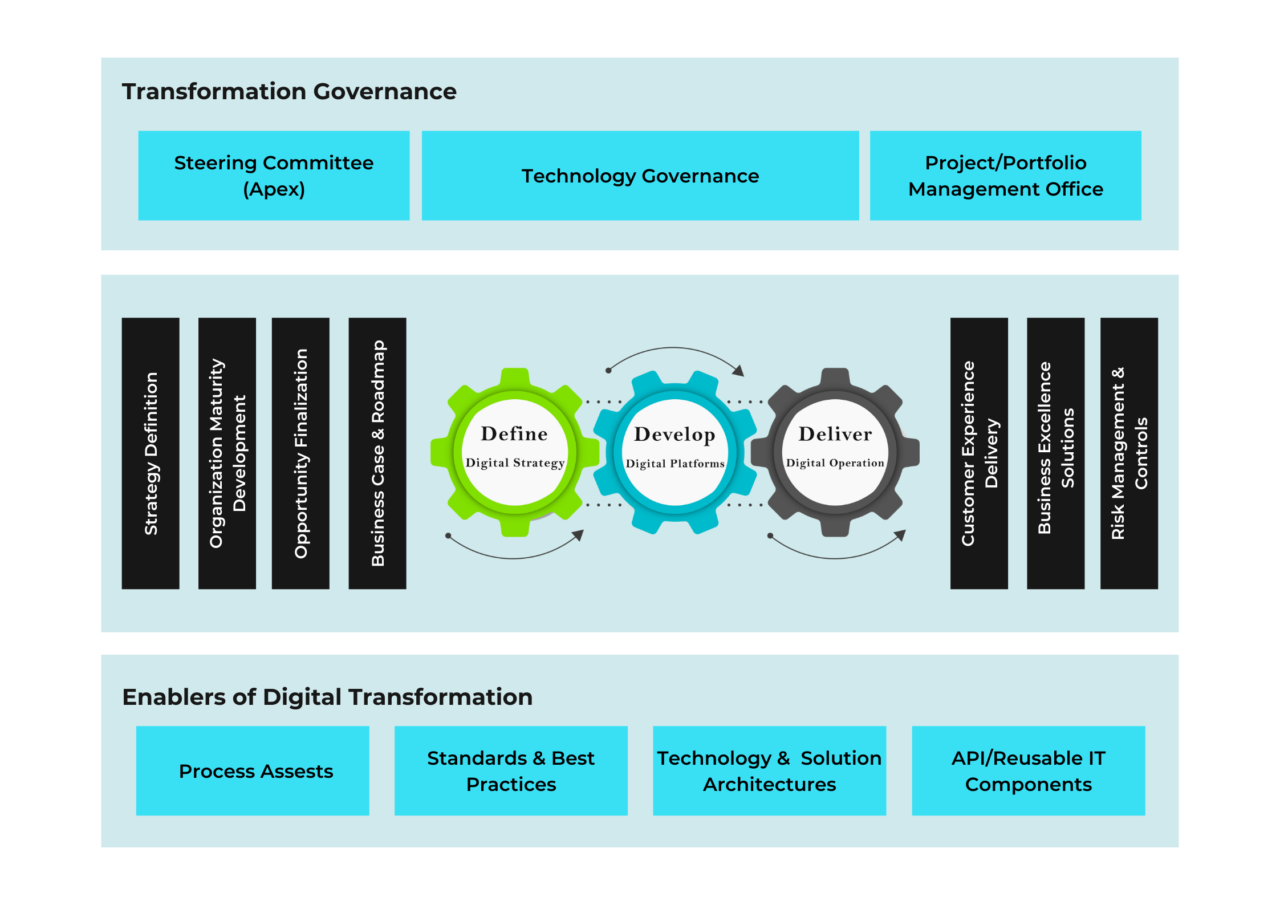

3D Approach (Define - Develop - Deliver)

Digital Transformation Journeys Examples

- Client Onboarding

- Creating an account

- Know-Your-Customer (KYC) Management

- Customer Account Management

- Management of BAU Operations (Customer Information Updates)

- Customer Service (Non-financial Transactions – Ex Balance Enquiry, Letters, and Issuance of Certificates). Transactions involving payments and money transfers

- Regulatory & Compliance

- Compliance and Audit

- Management of Mandatory Training and Disclosures Daily/Weekly/Monthly/Concurrent Review Management of Ongoing and Regulatory Controls

- New Business Services and Products

- Quick and customized product releases

- Personalized and new service definition

To summarise, digital transformation in banks entails much more than simply transitioning from traditional banking to a digital environment. It’s a game-changing shift in how banks and other financial institutions collaborate with multiple stakeholders to provide solutions. Understanding consumer and corporate goals and balancing them to execute changes that enable enterprises to leaps and bounds of profitability and success with unwavering customer happiness is the foundation of successful digital transformation.